Hôtel vs appart-hôtel vs appartement meublé : quelle option pour un séjour de 3 à 12 mois à Paris ?

Understand and control real estate capital gains

When a property is sold at a price higher than its purchase price or declared value, when the property comes from an inheritance or gift, a capital gain is generated. The latter is directly subject to income tax, except in the case where the property corresponds to the main residence of the seller. Other cases of exemptions exist, related to the nature of the property sold, but also to the quality of the buyer and the selling owner.

What is the real estate capital gain of individuals and how is it calculated? What is its imposition? When can it be exempted? What types of companies can be affected?

An update on how to calculate the real estate capital gain and its tax treatment.

- Immovable property, considered built or not built such as a house, an apartment or land.

- Immovable real rights such as bare ownership or usufruct.

- Shares in real estate companies.

Realized by individuals or partnerships, these companies carrying out a non-professional activity not subject to corporation tax, capital gains are subject to flat-rate taxation. Depending on the amount obtained, different allowances may apply before taxation, such as allowances for holding periods or temporary exceptional allowances.

Flat-rate taxation

Excluding exceptions, the real estate capital gain is subject to income tax, at the rate of 19%. An additional tax applies beyond € 50,000, considered as tax on high real estate capital gains: its rate ranges from 2% to 6% compared to the amount of the capital gain realized. Added to this is an overall rate of 17.2% of social security contributions. A final tax can potentially be added, the flat-rate tax on the transfer of bare land that has become buildable.

Simulate the situation related to your added value, go online to the official website of the notaries of France.

The transfer price

The one and only price to be taken into account is the one mentioned in the authentic instrument.

It is possible to deduct from the sale price, by various supporting documents, the costs incurred during the sale : commission of the real estate agency, costs related to mandatory diagnoses (DPE, lead, etc ...) and mortgage discharge.

The sale price must be increased by the indemnities and charges provided for in the deed, for the benefit of the seller, as well as the payment of costs charged to the buyers...

If the property is sold via a life annuity as consideration, the sale price used is the capital amount of the annuity, excluding interest.

Deductions for the duration of detention

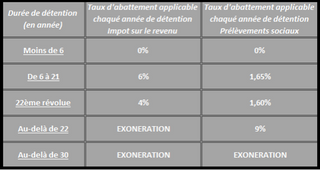

On transfers of immovable property, the methods of calculating the deduction for holding period vary on the taxable capital gain in respect of income tax (19 %) or social security contributions (17.2 %).

- The total exemption of real estate capital gains from income tax is thus obtained at the end of a holding period of 22 years.

Regarding social security contributions: the allowance is 1.65 % for each year of detention from the 5th to the 21st. 1.60 % for the 22nd year of detention and 9 % for any year beyond the 22nd.

- The total exemption from social security contributions is thus acquired at the end of a holding period of 30 years.

- Income tax 60 % (6 % x 10)

- Social security contributions 16.5 % (1.65 % x 10)

It will be possible to benefit from the total exemption, from 25 May N+22, from income tax and from 25 May N+30, from social security contributions.

The steps

The process related to the declaration of real estate capital gain can be laborious with a multitude of parameters governing its formalities.

On a sale involving a building or a building plot, it is necessary to call on a notary to carry out the payment formalities and the declarative formalities. By paying the tax and establishing the declaration of capital gain at the time of registration of the deed of sale with the service in charge of land registration.

On a sale involving company shares of a real estate nature, the use of a notary is optional. It is then necessary to file the deed under private signature with the service responsible for registering the domicile of one of the parties and in case of capital gain subject to the tax of the payment of the duties due and the declaration.

The purchase price

The stipulated purchase price may be increased by certain costs incurred at the time of acquisition, in the same way, provided that they can be justified:

- Indemnities and charges paid to the seller during the acquisition

- Acquisition costs: registration fees and VAT paid at the time of purchase, notary fees. In the event that it is impossible to justify them, deducting a lump sum of 7.5 % of the purchase price is allowed.

- The amounts spent in construction, reconstruction, expansion or improvement under certain conditions (carried out by a company ...), necessarily under proof.

- In the case of property held for more than 5 years and unable to provide proof, the deductible lump sum is 15 % of the purchase price.

- Road costs, networks and distributions of building land, whether or not imposed by local authorities as part of the land use plan or the local urban plan.

For goods paid via a life annuity, the capital value of the annuity is retained for the purchase price. Interest is not recognised.

Exceptional allowances

Exceptional allowances may apply, subject to conditions, in order to determine the net taxable capital gain, to income tax as well as to social security contributions. An exceptional allowance of 70% is applicable for the determination of the taxability of capital gains on disposals, realized on building land and built buildings. Provided that the purchaser undertakes to proceed with the demolition of existing buildings in order to rebuild housing, as soon as these lands or buildings are located in tense areas.

The latter is directly subject to income tax, except in the case where the property corresponds to the main residence of the seller.

Other cases of exemptions exist, related to the nature of the property sold, but also to the quality of the buyer and the selling owner.

The capital gain is the difference between the sale price and the purchase price.

The assignment can be a sale but also an exchange of goods, a division or a contribution among these three different categories:

- Immovable property, considered built or not built such as a house, an apartment or land.

- Immovable real rights such as bare ownership or usufruct.

- Shares in real estate companies.

You want to

to sell in Paris or its surroundings ?

Posted on 21/10/2021 by

Andy LECUYER